does instacart take out taxes for employees

You do get to take off the 50 er portion of the se tax as an adjustment on line 27 of the 1040. In Canada we usually get a tax form called a t4 from the employer which can be used to file the taxes.

Guide To Filing Tax Returns For Delivery Drivers In 2022

Indeed if your earnings in Instacart is above 600 per tax year you will receive a 1099-MISC tax form.

. For simplicity my accountant suggested using 30 to estimate taxes. 153 of that 9235 is 1413. This is because the irs does not require instacart to issue you a form if.

The total amount including all applicable taxes will become charged to your payment method on file when you receive your. For most Shipt and Instacart shoppers you get a deduction equal to 20 of your net profits. Instacart will file your 1099 tax form with the IRS and relevant state tax authorities.

Do not receive a w2 from Instacart. As an independent contractor you must pay taxes on your Instacart earnings. Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

The 1413 is the amount youll have to pay in self employment tax. You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes. No they do not.

Instead full-service shoppers are considered contract workers and they must file a 1099 form with the IRS during tax season. For gig workers like instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. Lets look at some common expenses youll have as an Instacart delivery driver.

To add PayPal as a form of payment to your Instacart. If you drive as a Lyft 1099 contractor for other rideshare apps or do other part-time gigs on the side. All companies including Instacart are only required to provide this form if they paid you 600 or more in a given tax year.

Your answer will be posted publicly. Since youre an independent contractor and classified as a sole proprietor you qualify for the Section 199A Qualified Business Income deduction. Instacart delivery starts at 399 for same-day orders 35 or more.

If you make more than 600 per tax year theyll send you a 1099-MISC tax form. Yes - in the US everyone who makes income pays taxes. Be sure to file separate Schedule C forms for each separate freelance work that you do ie.

What that ultimately means is your actual self employment tax is 1413 of your Schedule C profits. However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. So you get social security credit for it when you retire.

For SE self employment tax - if you have a net profit after expenses of 400 or more you will pay 153 for 2017 SE Tax on 9235 of your net. However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. Pay can be good but Instacart does not pay enough for a.

Does Instacart Take Out Taxes For All Employees. Does Instacart take out taxes for its employees. You should note that you dont have to pay self employment tax if your taxable profit is less than 400.

This form works for all. Help job seekers learn about the company by being objective and to the point. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

The SE tax is already included in your tax due or reduced your refund. You are considered an independent contractor so taxes are not withheld and you have to file them on your own. You do get to take off the 50 ER portion of the SE tax as an adjustment on line 27 of the 1040.

Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers. The price of gas varies greatly across the United States averaging as low as 263 per gallon in Mississippi to as high as 372 per gallon in California according to data from GasBuddy at the date of publication. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck.

Youll need your 1099 tax form to file your taxes. The taxes on your Instacart income wont be high since most drivers are making around 11 every hour. Great place to work if you need a flexible schedule.

Its a completely done-for-you solution that will help you track and. You wont send this form in with your tax return but you will use it to figure out how much business income to report on your Schedule C. Please dont submit any personal information.

As always Instacart Express members get free delivery on orders 35 or more per retailer. Does Instacart take out taxes. Instacart will bring on people who have felony convictions as shoppers provided the conviction is not within the last five years and the candidate has since demonstrated rehabilitation of their behavior.

The estimated rate accounts for Fed payroll and income taxes. You do get to take off the 50 er portion of the se tax as an adjustment on line 27 of the 1040. First fill out Schedule C with the amount you made as indicated in Box 7 on your Instacart 1099.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. How do I update my tax information. Download the Instacart app or start shopping online now with Instacart to get groceries alcohol home essentials and more delivered to you in as fast as 1 hour or select curbside pickup from your favorite local stores.

There will be a clear indication of the delivery fee when you are choosing your delivery window. What tax forms do Instacart shoppers get. You accept any loads that you are able and willing to take.

This is a standard tax form for contract workers. As youre liable for paying the essential state and government income taxes on the cash you make delivering for Instacart. Your earnings exceed 600 in a year.

This can make for a frightful astonishment when duty time moves around. You can review and edit your tax information directly in. For its full-service shoppers Instacart doesnt take out taxes from paychecks.

Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes. Does Instacart take out taxes for its employees. To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account.

The exception is if you accepted an employee position. Please note that all of this content is user-generated and its accuracy is not guaranteed by Indeed or this company. The taxes on your Instacart income wont be high since.

Reports how much money Instacart paid you throughout the year. Instacart Shopper Current Employee - Tennessee - March 15 2022. IRS deadline to file taxes.

This includes self-employment taxes and income taxes. That means youd only pay income tax on 80 of your profits. Except despite everything you have to put aside a portion of the.

Because instacart shoppers are contractors the company will not take taxes out of your paycheck.

Does Instacart Take Out Taxes In 2022 Full Guide

Filing Your 2021 Taxes Skipthedishes Courier Help Centre

The Ultimate Guide To Paying Quarterly Taxes Everlance

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

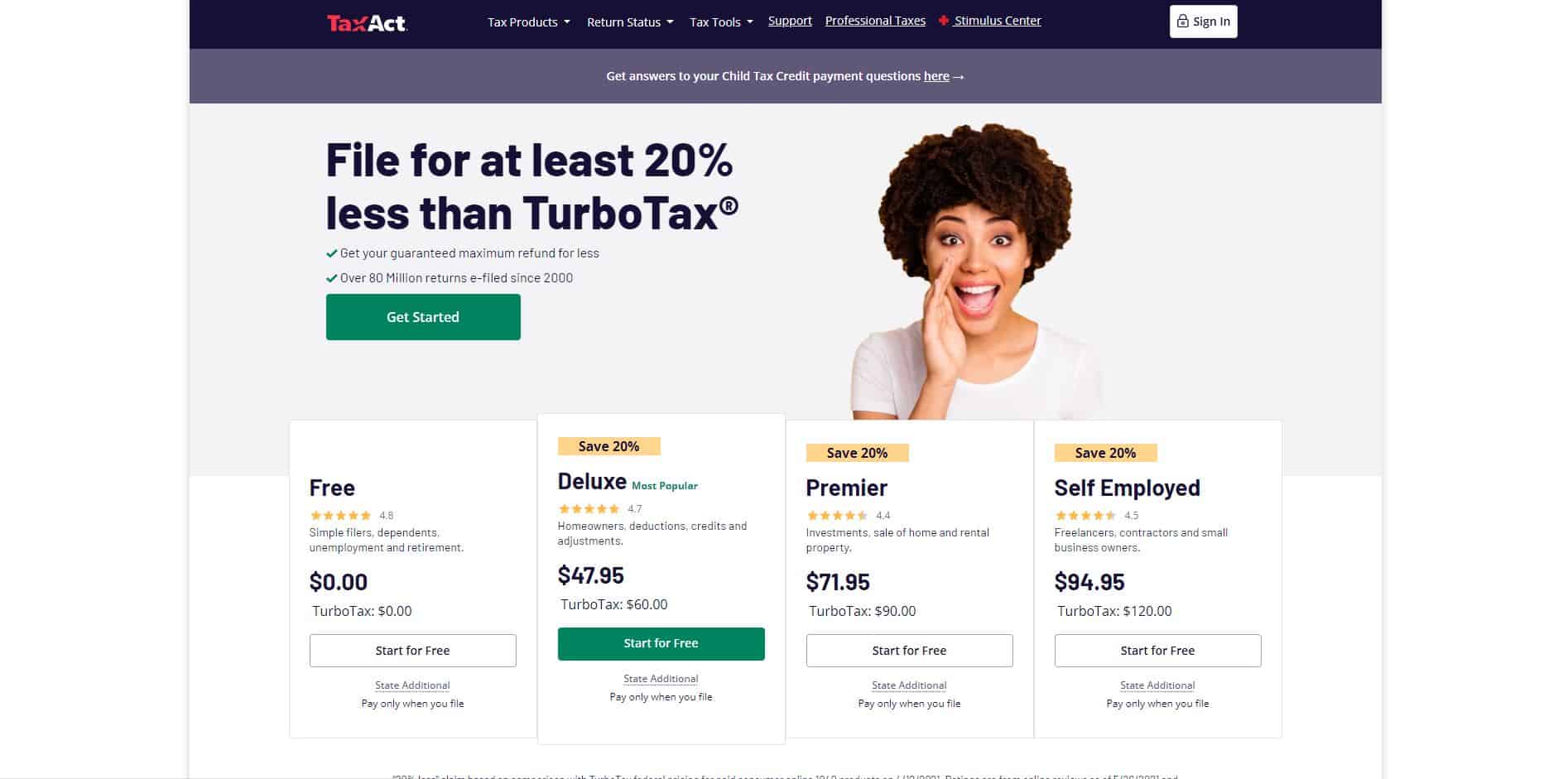

How To File Taxes As An Independent Contractors H R Block

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart Taxes Net Pay Advance

The Uber Eats Driver S Complete Guide To Self Employment Tax Entrecourier

What You Need To Know About Instacart Taxes Net Pay Advance

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support

1099 Taxes For Gig Workers Explained Expert Advice For Independent Contractors 2020 Instacart Youtube

Freelance Taxes In Canada 9 Things You Need To Know 2022 Turbotax Canada Tips

What You Need To Know About Instacart Taxes Net Pay Advance

This Post Will Walk Through The Fourth Report In Bluegranite S Power Bi Showcase A Series Designed To Highlight K Employee Retention Data Visualization Power

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube